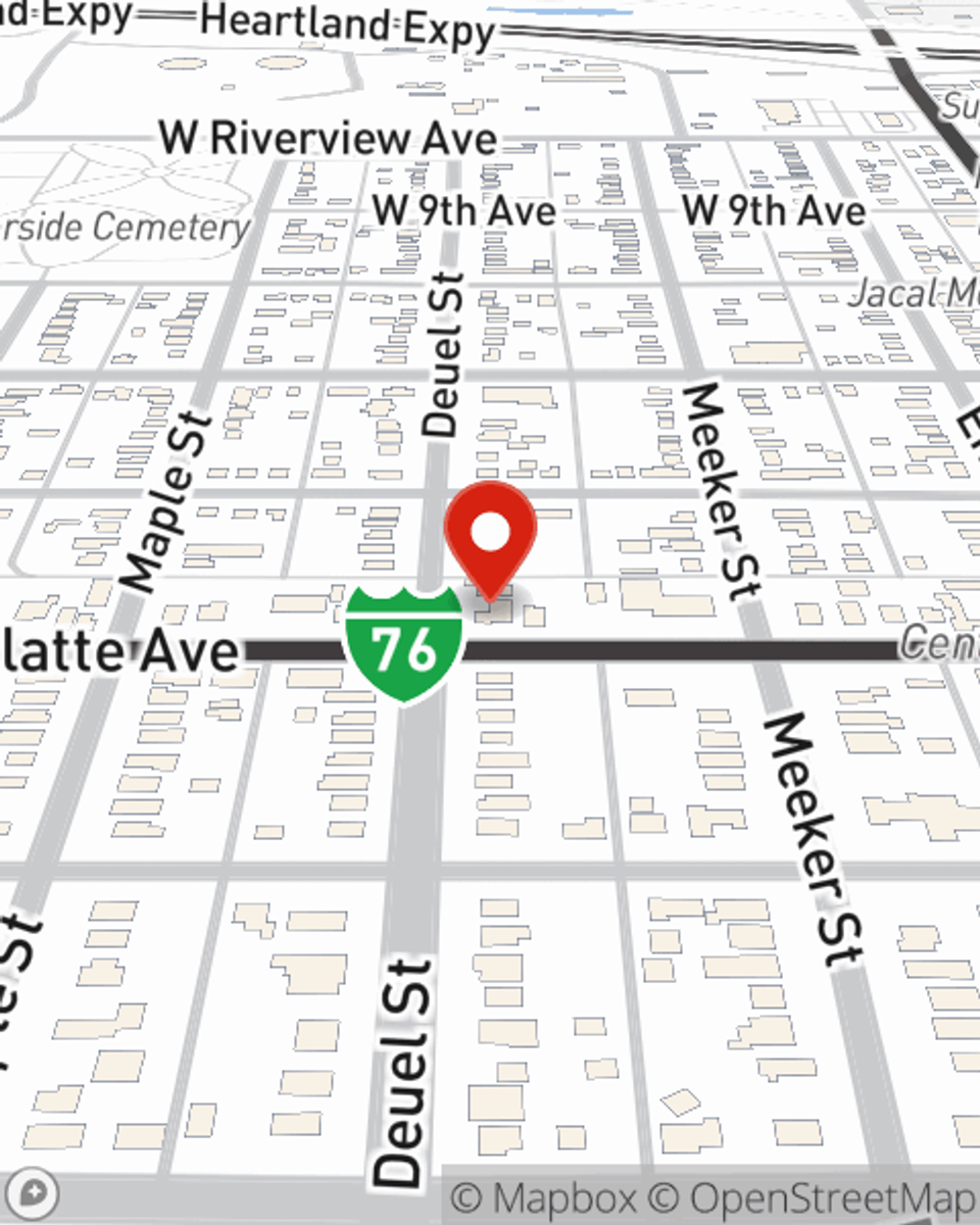

Homeowners Insurance in and around Fort Morgan

Homeowners of Fort Morgan, State Farm has you covered

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

Home Sweet Home Starts With State Farm

Stepping into homeownership is a big responsibility. You need to consider cosmetic fixes neighborhood and more. But once you find the perfect place to call home, you also need great insurance. Finding the right coverage can help your Fort Morgan home be a sweet place to be.

Homeowners of Fort Morgan, State Farm has you covered

The key to great homeowners insurance.

Agent Kelly Siebrands, At Your Service

State Farm's homeowners insurance covers your home and your memorabilia. Agent Kelly Siebrands is here to help build a policy with your specific needs in mind.

Don't let your homeowners insurance go over your head, especially when the unanticipated occurs. State Farm can bear the load of helping you figure out what works for your home insurance needs. And if that's not enough, bundle and save could be the crown molding to your coverage options. Contact Kelly Siebrands today for more information!

Have More Questions About Homeowners Insurance?

Call Kelly at (970) 867-3028 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How a storm shelter or safe room can help protect against severe weather

How a storm shelter or safe room can help protect against severe weather

Constructing a storm shelter or safe room space within your home can help protect you from natural disasters and weather emergencies.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Kelly Siebrands

State Farm® Insurance AgentSimple Insights®

How a storm shelter or safe room can help protect against severe weather

How a storm shelter or safe room can help protect against severe weather

Constructing a storm shelter or safe room space within your home can help protect you from natural disasters and weather emergencies.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.